How to Save Money on Home Insurance: Tips and Tricks

Introduction

Home insurance is an essential tool for protecting your home and belongings from unexpected events like theft, fire, or natural disasters. However, just like any insurance, home insurance can be costly. Understanding how to choose the right policy and finding ways to save money can help you provide the best protection for your home without overspending. Here’s a guide to help you navigate home insurance options and find the best ways to save.

How to Choose the Right Home Insurance for You

Assess Your Home's Needs

•Evaluate Your Home’s Value: Start by understanding the value of your home and its contents. This will help you determine how much coverage you need. If your home has high-value items like jewelry or electronics, you may want additional coverage to protect these assets.

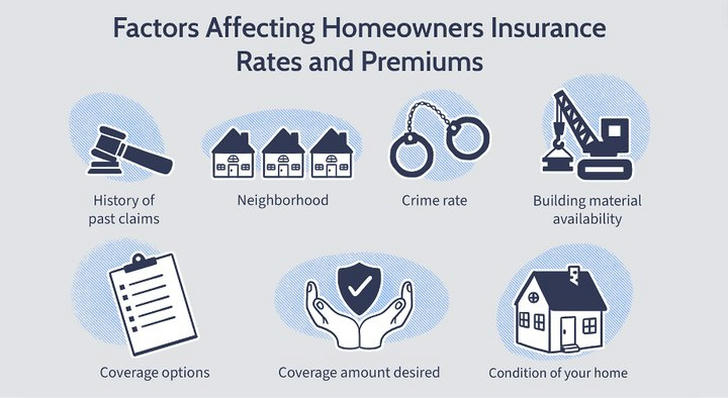

•Consider Your Location: The location of your home significantly impacts your insurance needs. Homes in areas prone to natural disasters like floods, earthquakes, or hurricanes may require additional coverage. Similarly, homes in high-crime areas may need extra protection against theft and vandalism.

Check Coverage for Common Home Risks

•Structural Coverage: Ensure that the insurance plan covers the cost of repairing or rebuilding your home if it is damaged by covered perils like fire, storms, or vandalism. This is often the primary coverage in a home insurance policy.

•Personal Property Coverage: Look for coverage that protects your belongings inside the home. This includes furniture, clothing, appliances, and other personal items. Make sure the policy covers the replacement cost rather than the actual cash value, which accounts for depreciation.

•Liability Coverage: This coverage protects you if someone is injured on your property and you are found liable. It’s important to have sufficient liability coverage to protect your assets in case of a lawsuit.

Consider Additional Benefits

•Flood and Earthquake Insurance: Standard home insurance policies typically do not cover damage from floods or earthquakes. If you live in an area prone to these disasters, consider adding this coverage.

•Replacement Cost vs. Actual Cash Value: Some policies offer replacement cost coverage, which pays to replace your home and belongings without deducting for depreciation. This can be more expensive but provides more comprehensive protection than actual cash value coverage, which deducts for depreciation.

User Story: Sarah's Home Insurance Decision

Sarah owns a 3-bedroom house in a coastal area where hurricanes are common. With valuable electronics and antique furniture to protect, she compared two home insurance plans. Plan A had a lower monthly premium of $70 but came with a higher deductible of $1,000. It offered up to $200,000 in structural coverage and used actual cash value for personal property, meaning items would be valued at their depreciated worth. Plan A also provided $100,000 in liability coverage but didn’t include flood or earthquake insurance. Plan B, on the other hand, cost $100 per month but had a lower deductible of $500. It offered up to $300,000 in structural coverage, replacement cost for personal property (which means items would be replaced at their full value), and $300,000 in liability coverage. It also included both flood and earthquake insurance. Despite the higher premium, Sarah chose Plan B because it offered better protection for her home and belongings, along with additional coverage for natural disasters, ensuring she is well-prepared for any risks in her area.

What are the Different Home Insurance Options?

Home insurance comes in various types, each tailored to meet different needs and budgets. If you're a homeowner looking for basic protection, an HO-1 policy might be a good fit, offering minimal coverage for things like fire and theft at a low cost but without extra benefits. For most homeowners, an HO-3 policy provides a moderate level of coverage for a broad range of perils, with some exclusions, and might include options for replacing lost or damaged items. If you have high-value possessions, an HO-5 policy could be the best choice, offering comprehensive coverage for all perils except those specifically excluded and often including replacement costs for all items, though it comes at a higher cost. For condo owners, an HO-6 policy covers personal property and any damage to the interior of the unit, typically at a low to moderate cost, and may also include liability and loss assessment coverage. Lastly, if you’re renting, an HO-4 renters insurance policy is a low-cost option that covers your personal belongings and liability, and might even help with additional living expenses if your rental becomes uninhabitable.

How to Find Discounts and Save Money on Home Insurance

Shop Around and Compare Quotes

•Why It Helps: Home insurance premiums can vary significantly between providers, so it’s important to compare quotes to find the best deal.

•How to Do It: Use online tools to compare plans from different insurers and talk to multiple providers to find the coverage that fits your home’s needs and your budget.

Bundle with Other Insurance Policies

•Why It Helps: Some insurers offer discounts if you bundle home insurance with other policies, like auto or life insurance.

•How to Do It: Check with your current insurance provider to see if they offer a bundling discount or look for a company that does.

Improve Your Home’s Safety

•Why It Helps: Insurers often offer lower premiums for homes with safety features such as smoke detectors, burglar alarms, or storm shutters.

How to Do It: Invest in safety and security features for your home. Some insurers may offer discounts if you upgrade your home with these safety measures.

Raise Your Deductible

•Why It Helps: A higher deductible can lower your premium because you agree to pay more out of pocket in case of a claim.

•How to Do It: Review your financial situation to determine how much you can afford to pay if you need to make a claim. Choose a deductible that balances your budget with your risk tolerance.

Look for Loyalty Discounts

•Why It Helps: Some insurers offer discounts to customers who stay with them for a certain number of years.

•How to Do It: Check with your current insurer about any loyalty discounts they may offer for long-term customers. It can be worth it to stick with a company if they provide significant savings.

Conclusion

Saving money on home insurance involves understanding your home’s needs, comparing different plans, and taking advantage of discounts and benefits. By choosing the right coverage and implementing safety measures, you can ensure your home is well protected without overspending. Regularly reviewing your policy and being proactive about home maintenance will help you find the best value and provide peace of mind.